Asset Liability Management Module: The Endgame of Stablecoins

Introduction

UXD Protocol released its stablecoin in January this year and there is currently $15M UXD in circulation, from an ATH of $40M in the past. UXD has kept its peg since then, and remained quite stable, even during a period of extreme volatility in crypto markets, proving that delta-neutral position is a viable stability mechanism when coupled with a native mint/redeem mechanism. Due to a lack of activity on Solana in recent months, and in particular a lack of open interest on Mango Markets (the venue we currently integrate with to create the delta-neutral position) as UXD scales our short position becomes a larger percentage of the OI and funding rates are pushed to negative rates.

UXD Protocol had always understood and noted this publicly as a potential risk, but had projected higher activity on Solana all around. The delta-neutral position is an elegant solution to back a stablecoin since, if managed carefully, and in the right market environments, the position generates yield and preserves stability. However, the position does not scale automatically and is capped by general levels of activity. We think the delta-neutral position should be managed so that it doesn’t become too large relative to the open interest of the derivative dex and will continue to be one of the various strategies to back the stablecoin. This is the reason for the recent introduction of the $15mm cap on the outstanding supply of UXD.

We introduce the Asset Liability Management Module, a generalized strategy that we believe will be the endgame of stablecoins. (Similar strategies are being pursued by Maker and Frax). This will potentially enable UXD to scale to billions efficiently and at the same time, generate positive cash flow via various sustainable sources of yield on the asset side. The Asset Liability Management Module can be applied cross-chain, thus making UXD a modular structure that is agnostic between chains and can maintain various asset positions across a variety of chains.

Asset Liability Management Module

Fundamentally, stablecoins are tokens that are pegged to a fiat currency, generally USD. More specifically, stablecoins are tokens that aim to minimize the volatility of the price relative to their chosen base currency. We believe that the best way to achieve this is to create a structure that enables anyone to mint/redeem 1 UXD with 1 USD. For example, the delta-neutral position-backed stablecoin enables anyone to mint/redeem UXD at par value and allows anyone to arbitrage the price difference if the price drifts from the peg, thus ensuring the peg.

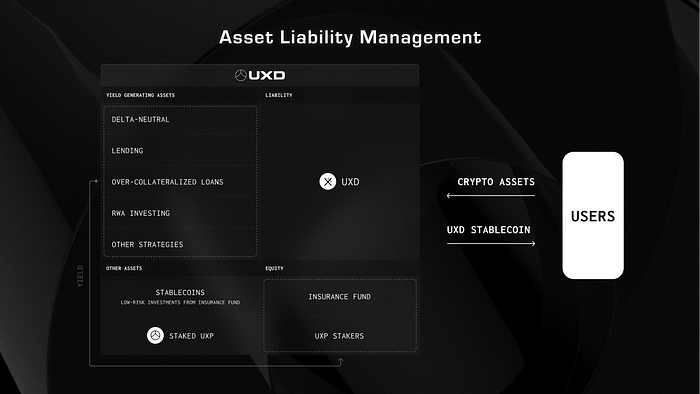

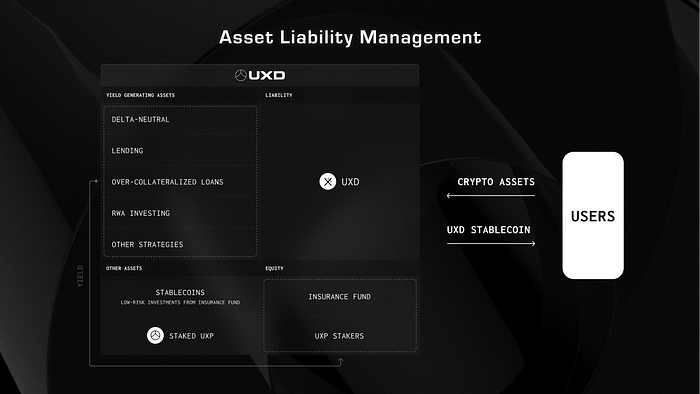

The asset liability management module is a structure that combines various low risk* strategies to back the stablecoin. These strategies generate yield, which will accrue to UXP stakers and the insurance fund. The graphic below is a high level overview of the architecture of the asset liability management module.

*Based on judgements from UXD Protocol and its community

A brief explanation of the various strategies.

Delta-Neutral position: A long SOL spot short SOL perpetual futures position is an example of a delta-neutral position. This position has a delta of zero, which means that market fluctuations have no effect on the value of the position. When funding rates are positive, UXD protocol earns the yield. When funding rates are negative, UXD protocol pays those costs.

Lending: Supplying stablecoins on lending platforms to earn yield, on an overcollateralized basis, similar to MakerDao’s D3M.

Overcollateralized loans: Users will be able to borrow UXD by supplying crypto assets. This enables traders to gain leverage and UXD Protocol will earn the borrow fee.

Real World Asset Investing: By utilizing RWA investment platforms such as Credix, Maple, Goldfinch, Clearpool, etc UXD Protocol can create loans against real world assets as collateral. This enables UXD Protocol to access real-world credit opportunities and earn superior risk-adjusted yield.

By managing the risks of the various strategies on the asset side, we can create a low risk, diversified portfolio that will stabilize UXD and earn interest for the stakeholders of UXD Protocol.

Risks

Since UXD will be backed by multiple strategies, the protocol is exposed to various risks, such as smart contract risk, liquidity risk, solvency risk, etc. At the same time, the various strategies diversify the risk and ensure that the loss of capital from one of the strategies is not crucial to the protocol. In a scenario where the asset side suffers losses, the insurance fund will pay out the losses. If the losses exceed the capital in the insurance fund, UXP stakers will pay for the losses through an auction sale of their stake. If this amount is still not enough to cover losses, UXD stablecoin holders would become undercollateralized and UXD would likely lose its peg.

Productive Asset

Arguably, transforming a pure governance token into a cash-flow-generating governance token is the holy grail in DeFi. Most governance tokens do not accrue any value besides voting rights, which in the long run is not enough to create sustainable value for stakeholders. We believe that decentralized governance tokens that generate sustainable cash flow for token holders are the future of DeFi.

The new structure of UXD Protocol will transform UXP into a nire productive asset. Since the asset side of UXD Protocol will earn interest through low-risk strategies such as delta-neutral position, lending, overcollateralized loans, and RWA investing, UXP token holders may be able to receive these cash flows, possibly subject to certain terms and conditions. We will first start with a simple buyback model due to the simplicity and ease of implementation. This model will have interest generated from the asset side used to buyback UXP tokens from the open market and sent to the community pool. Later on, UXD Protocol will most likely transition to the veREV model, and UXP stakers will be the primary beneficiaries of the cash flows.

Initial version of UXD ALM

UXD Protocol will first integrate with Mercurial Vault, which is essentially a yield aggregator for various lending protocols on Solana, such as Solend, Mango Markets, Port, etc. The vault will automatically manage UXD Protocol’s stablecoin reserve and deploy its capital in various lending protocols to maximize yield. This yield will be used to buyback UXP tokens from the open market and in the future transition to veREV.

The initial version will support USDC but we will add other stablecoins as UXD scales.

Mint fee is free and redeem fee is 0.05%, which may be changed in the future.

How the Insurance Fund functions within the system

UXD Protocol has $53.5M in the insurance fund, which is currently reserved to pay for negative funding rates from the delta-neutral position. After UXD Protocol transitions to the Asset Liability Management Module, the insurance fund will be used not only to pay out negative funding rates but it will also become the final buffer of the protocol, hence acting as the “equity” part of the balance sheet.

Transition phase

Since the Asset Liability Management Module is a significant change in the UXD architecture, we would like to transition to this model via a vote by the community.

There will be a 7-day voting period and if the number of yes votes exceeds 1% of the total UXP supply threshold and yes votes > no votes, UXD Protocol will transition to the Asset Liability Management Module.

UXP token holders and stakers can vote here.

https://governance.uxd.fi/dao/UXP/proposal/HLt18XamrvTFGUKaaEVS6wRBL3eLNfzVZAaxFapNMdoy

Join our Discord and follow us on Twitter to be updated with the most recent news regarding UXD Protocol!

All design specs above are preliminary and subject to change. Receipt of “yield” may be subject to applicable laws and regulations, including restriction of certain jurisdictions. UXP is not meant to be, or advertised as, an investment of any sort.